Privy Partners with Coretax to Offer Free Services for Tax Office

In a move to support the government’s tax digitalization efforts, Privy, an electronic certification provider, has announced that they will be offering free electronic certificate and electronic signature services on the Coretax application. This partnership aims to streamline the tax process and enhance efficiency in tax administration.

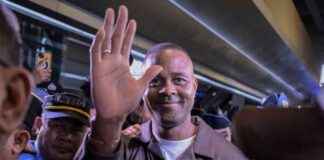

CEO’s Positive Outlook on Collaboration

Marshall Pribadi, the CEO and Founder of Privy, expressed his enthusiasm for the collaboration between the Directorate General of Taxes (DJP) and Privy. He highlighted the importance of certified electronic signatures and electronic certificates in the digitalization of tax processes, emphasizing the significant time and cost savings these services will provide.

Benefits for Taxpayers and Data Security

Marshall also emphasized the importance of privacy and data security for taxpayers, stating that Privy prioritizes the protection of taxpayer data. The implementation of the Core Tax Administration System (SIAP) by the government on January 1, 2025, marks a significant step in the digitalization of tax processes, despite initial challenges.

Streamlining Tax Processes with Coretax

Coretax, as part of the tax reform efforts by the DJP, aims to simplify tax obligations for taxpayers by digitizing tax processes. Taxpayers are now required to use electronic signatures for tax document signing, with the option to obtain electronic certificates through the Privy application available on Playstore/IOS. This streamlined process will make tax compliance more accessible and efficient for taxpayers.

Marshall highlighted the strategic partnership between Privy and DJP as a catalyst for raising taxpayer awareness and creating a digital ecosystem within the community. This collaboration is expected to have a significant impact on tax compliance and service delivery, ultimately enhancing the overall tax system in the country.

With the free services offered by Privy on the Coretax platform, taxpayers can expect a more seamless and efficient tax filing experience. The integration of electronic certificates and signatures will not only simplify the tax process but also ensure the security and authenticity of tax documents. This initiative represents a significant step towards modernizing tax administration and fostering a culture of compliance among taxpayers.